Transaction Advisory Services

At Quickspace Ltd, we provide comprehensive transaction advisory services to help businesses navigate complex transactions such as mergers, acquisitions, divestitures, joint ventures, and restructurings. Our specialized expertise ensures a successful transaction lifecycle from strategic planning and execution to post-transaction integration.

Our Comprehensive M&A Services

Business Valuation

We offer precise and detailed business valuation services to provide an accurate assessment of your business’s worth. This is crucial for making informed decisions in transactions such as mergers, acquisitions, and divestitures.

- Initial Valuation Assessment

- Comprehensive Financial Analysis

- Fair Market Value Estimation

- Strategic Planning and Advice

Key Benefits of Our Business Valuation Services:

- Informed Decision Making: Gain the confidence to make strategic decisions with a thorough understanding of your business’s value.

- Objective Assessment: Receive an unbiased, expert evaluation that reflects true market conditions.

- Financial Planning: Utilize our valuation reports to support your financial planning, investment strategies, and negotiations.

Sell-Side Advisory

Our sell-side advisory services are designed to optimize transaction terms and proceeds for sellers. We guide you through every step, ensuring an efficient process and favorable outcomes.

- Development of Confidential Information Memorandum

- Potential Buyer List Development

- Comprehensive Due Diligence (financial, operational, legal, regulatory)

- Deal Structuring and Negotiation Support

- Integration Planning and Post-Merger Assistance

What We Offer in Sell Side Due Diligence:

- Detailed Financial Review: Examine financial statements, cash flow, and profitability to present a clear and accurate financial picture.

- Operational Analysis: Evaluate operational efficiencies, management structures, and key performance indicators.

- Market Position Assessment: Analyze market trends, competitive positioning, and growth opportunities.

Buy-Side Advisory

Our buy-side advisory services help buyers identify and evaluate potential acquisition targets, ensuring a strategic fit and optimal transaction outcomes.

- Target Identification and Screening

- Valuation Analysis and Financial Modeling

- Comprehensive Due Diligence (financial, operational, legal, regulatory)

- Deal Structuring and Negotiation Support

- Integration Planning and Post-Acquisition Assistance

Comprehensive Buy Side Due Diligence Includes:

- Financial Health Check: Scrutinize financial records to identify any potential red flags or hidden liabilities.

- Strategic Fit Analysis: Assess how well the target company aligns with your strategic goals and objectives.

- Risk Mitigation: Identify and evaluate potential risks, ensuring you are fully informed before making a purchase decision.

Divestitures and Carve-Outs

We assist in the sale or separation of business units, subsidiaries, or product lines, ensuring a smooth and successful transaction.

- Preparing Carve-Out Entity for Separation

- Conducting Due Diligence on Divested Assets or Business Units

- Valuation and Pricing Analyses

- Identifying Potential Buyers or Investors

- Negotiating and Structuring the Transaction

Joint Ventures and Strategic Alliances

Our services support the formation and management of joint ventures and strategic alliances, ensuring a collaborative and profitable partnership.

- Due Diligence on Potential Partners

- Structuring and Negotiating Agreements

- Valuation and Financial Modeling for Joint Ventures

- Governance and Operational Structures

- Regulatory and Legal Compliance

Restructurings and Reorganizations

We provide expert guidance in restructuring and reorganizing your business to enhance financial and operational efficiency.

- Conducting Financial and Operational Due Diligence

- Developing Restructuring Plans and Strategies

- Advising on Debt Restructuring, Asset Sales, or Business Rationalization

- Assisting with Bankruptcy or Insolvency Proceedings

- Ensuring Legal and Regulatory Compliance

Initial Public Offerings (IPOs) and Capital Market Transactions

Our advisory services support companies in navigating the complexities of going public and other capital market transactions.

- Conducting Due Diligence on Financials and Operations

- Assisting with Financial Reporting and Compliance Requirements

- Valuation Analyses and Pricing of Offerings

- Advising on Regulatory and Legal Requirements

- Supporting Marketing and Investor Relations Efforts

Industries We Serve

Aerospace

The aerospace industry is characterized by high innovation, stringent regulations, and significant capital investment. Our expertise in aerospace M&A services ensures that you navigate these complexities with ease.

Our Aerospace M&A Services Include:

- Technology and Innovation Assessment: Evaluate the technological capabilities and innovation potential of target companies.

- Regulatory Compliance: Ensure all transactions comply with industry regulations and standards.

- Market Analysis: Provide insights into market trends, competitive landscape, and growth opportunities.

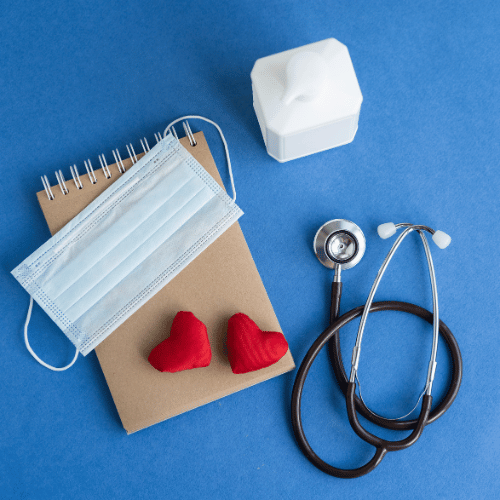

Healthcare

The healthcare industry is rapidly evolving, with constant advancements in medical technology and changing regulatory environments. Our M&A services in healthcare are designed to help you stay ahead of the curve.

Specialized Healthcare M&A Services:

- Clinical and Operational Due Diligence: Assess clinical operations, patient care quality, and operational efficiencies.

- Regulatory and Compliance Review: Navigate the complex regulatory landscape with expert guidance.

- Market Position and Growth Potential: Analyze market trends and identify growth opportunities within the healthcare sector.

Agriculture

The agriculture industry is vital to global food security and economic stability. Our M&A services in agriculture focus on enhancing operational efficiencies and driving growth.

Key Services for Agriculture M&A:

- Supply Chain and Logistics Evaluation: Assess the efficiency and reliability of supply chains and logistics.

- Sustainability and Environmental Impact: Evaluate sustainability practices and environmental impact.

- Market Trends and Demand Analysis: Provide insights into market trends, consumer demand, and growth opportunities.

Pharmaceutical

The pharmaceutical industry is at the forefront of innovation, developing life-saving drugs and therapies. Our M&A services in this sector focus on maximizing the value of transactions and ensuring regulatory compliance.

Comprehensive Pharmaceutical M&A Services:

- Research and Development Assessment: Evaluate the R&D capabilities and pipeline potential of target companies.

- Regulatory Compliance and Risk Management: Ensure compliance with industry regulations and manage potential risks.

- Market Potential and Competitive Analysis: Analyze market potential and competitive positioning.

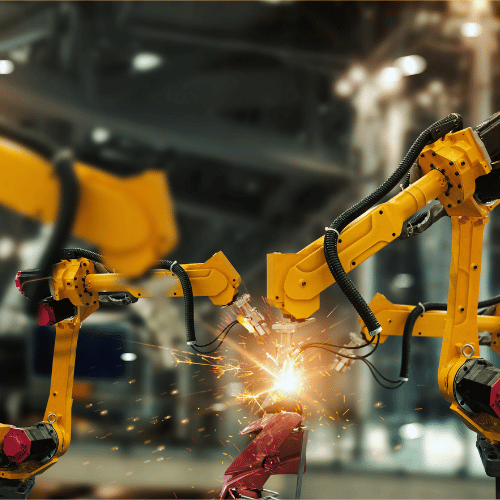

Automotive

The automotive industry is undergoing a transformation with advancements in electric vehicles, autonomous driving, and connected technologies. Our M&A services help you capitalize on these trends.

Tailored Automotive M&A Services:

- Technological Innovation and Integration: Assess the technological capabilities and integration potential of target companies.

- Market Dynamics and Consumer Trends: Provide insights into market dynamics, consumer preferences, and growth opportunities.

- Operational and Financial Analysis: Evaluate operational efficiencies and financial health.

Why Choose QuickSpace Ltd?

Unmatched Expertise and Industry Knowledge

Our team of seasoned professionals brings a wealth of experience and industry knowledge to every transaction. We understand the unique challenges and opportunities within each sector we serve, ensuring that our clients receive tailored solutions that meet their specific needs.

Proven Track Record of Success

Our proven track record of successful transactions speaks to our ability to deliver results. We have helped numerous clients achieve their M&A objectives, driving growth and creating value.

Commitment to Excellence and Integrity

At QuickSpace Ltd, we are committed to maintaining the highest standards of excellence and integrity. Our rigorous due diligence processes and comprehensive analyses ensure that our clients are well-informed and positioned for success.

Cutting-Edge Tools and Technology

We leverage cutting-edge tools and technology to provide our clients with the most accurate and up-to-date information. Our advanced analytics and data-driven insights ensure that you have the information you need to make informed decisions.

Client-Centric Approach

We believe that every client is unique, and we strive to provide personalized services that align with your strategic goals. Our client-centric approach ensures that we are always focused on delivering value and exceeding expectations.

Contact Us Today

If you are considering a merger, acquisition, or need a precise valuation of your business, QuickSpace Ltd is here to help. Contact us today to learn more about our services and how we can support your strategic goals.

How to Reach Us

- Phone: +44-736-023-5736

- Email: info@quickspace.ltd

- Website: www.quickspace.ltd